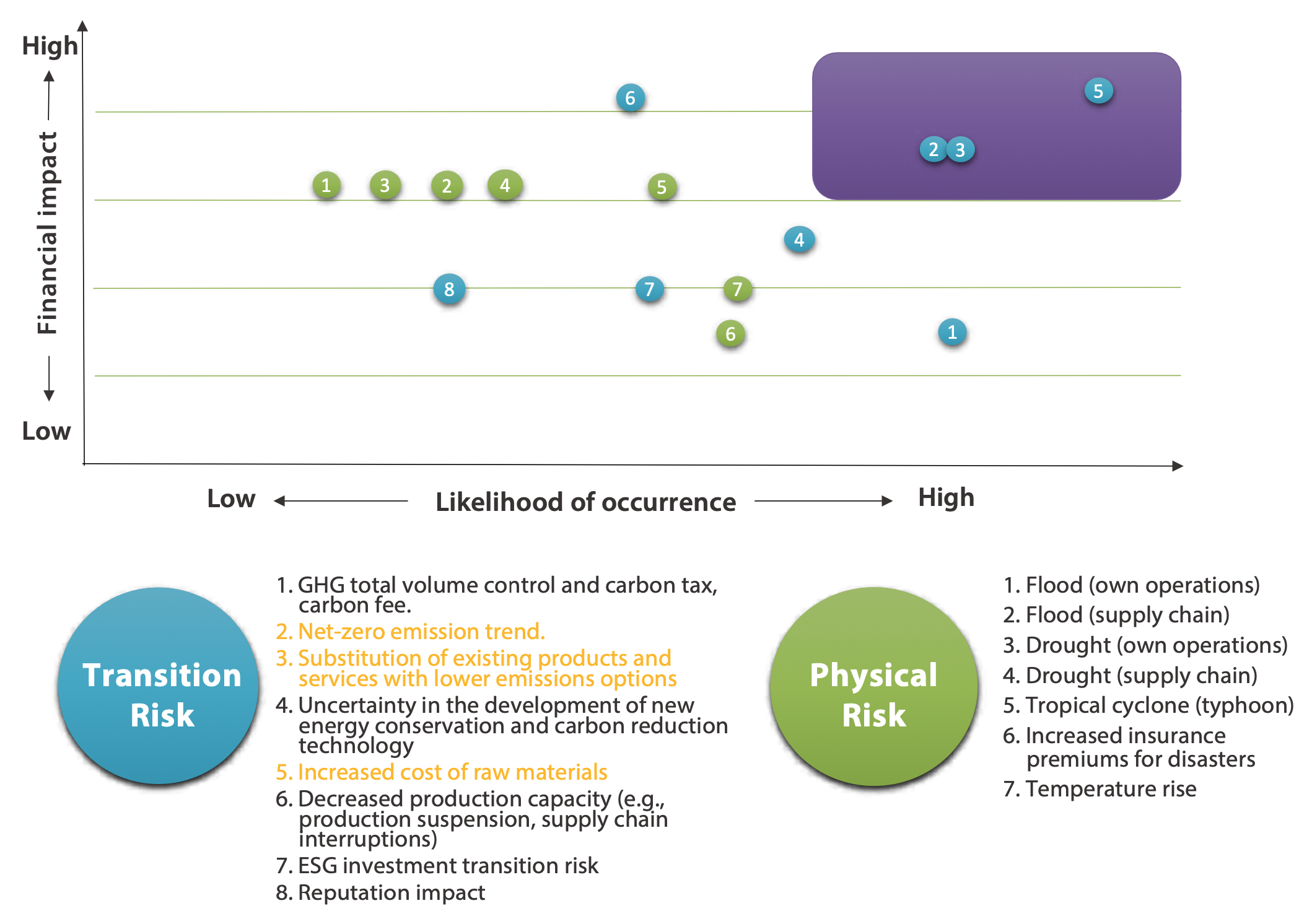

After the successive announcement and passage of the UN Sustainable Development Goals (SDGs) and Paris Agreement, adaptation to and mitigation of climate change have become key missions of global economic development. In recognition of the physical and transitional risks and opportunities brought by climate change, we carried out a full inventory of policy and legal, technology, market, and reputation risks and opportunities as countermeasures, and progressively disclosed our actions taken to address climate change in terms of the TCFD core elements of governance, strategy, risk management, and metrics and targets in order to optimize the control of climate-related risks year after year. In March 2022, we signed our support for the Task Force on Climate-related Financial Disclosures (TCFD) published by the Financial Stability Board (FSB), published an independent report, and passed a third-party management audit. In April 2022, we joined the Science-Based Targets initiative (SBTi) and submitted the net zero emissions targets in November of the same year.

Financial impacts of risks, opportunities and countermeasures

| Risk | Potential financial impacts | Key Counteractions |

|---|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

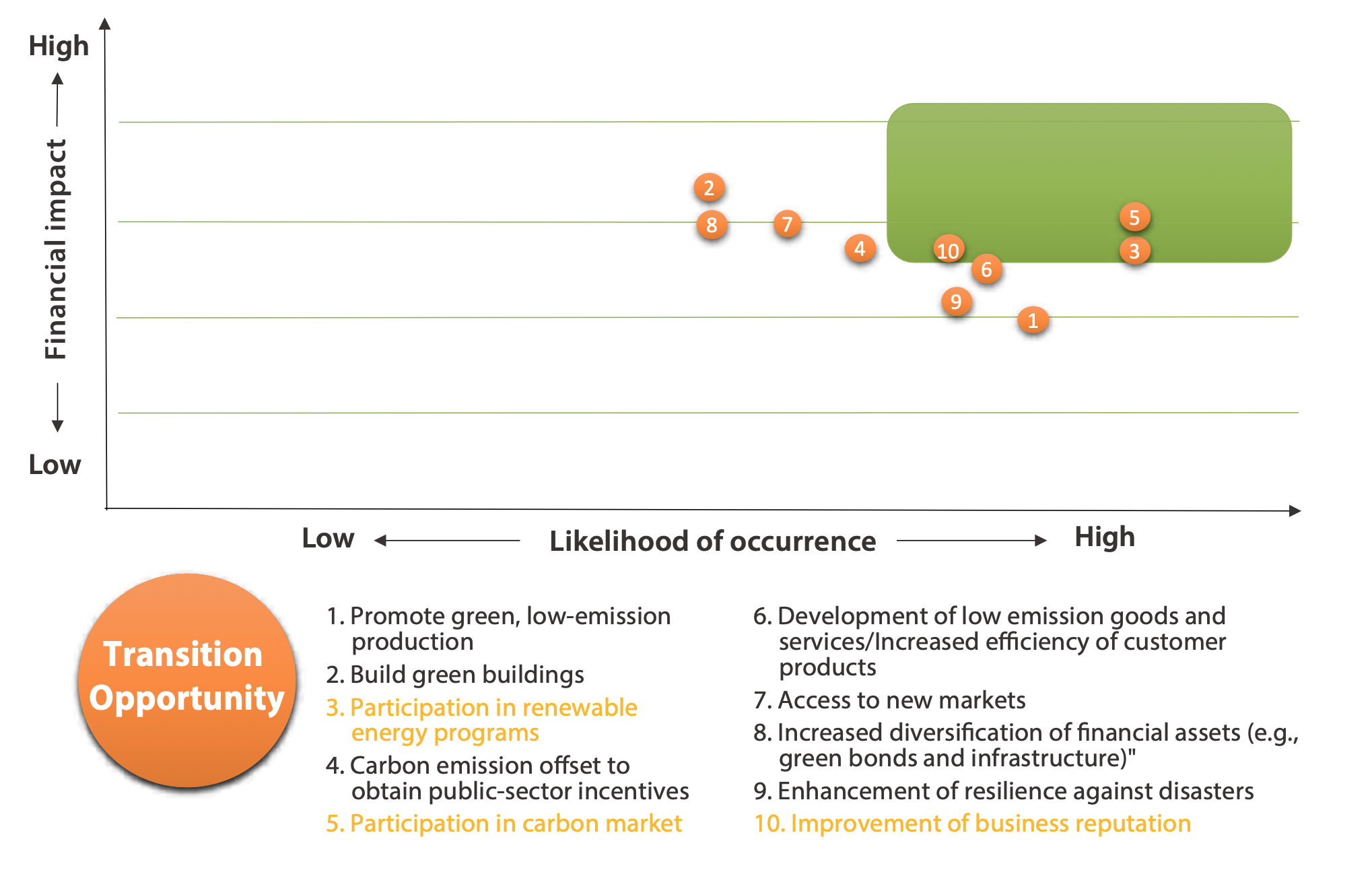

| Opportunity | Potential financial impacts – / + | Key Counteractions |

|---|---|---|

| Participation in carbon market | + Reduced exposure to GHG emissions + Participation in carbon market together with professional environmental assessment and green power platforms to increase operational capacity and revenues. | Provision of methodologies for professional carbon accounting, emission allowance and CCSR trade, carbon assets, and carbon/emission reduction for businesses engaging in carbon trade to improve carbon management capability. |

| Participation in renewable energy programs | + Extraction of biogas from livestock wastewater, construction of solar PV stations, investment in the solar energy industry, and returns on investment in low-emission technology. + Reduced exposure to GHG emissions and therefore less sensitivity to changes in cost of carbon | Promotion of the green economy and environmental sustainability by implementing renewables with technologies including fishery and electricity symbiosis and smart culturing. |

| Improvement of business reputation | + Active engagement in international climate actions, practice of low- emission strategies, and becoming the first-choice quality supplier of leading manufacturers resulting in increased demand for goods/ services. + Facilitating labor management and planning (e.g., employee recruitment and retention) + Increased financing convenience/capital increase | Improvement of the green business image through engagement with recycling technology and green innovation. |

| Development of low emission goods and services / Increased efficiency of customer products | + Cultivation of sources for low-carbon materials resulting in increased venues with low-emission products and services. + Better competitive position to reflect shifting consumer preferences, resulting in increased revenues + Development of recycling and reuse technologies to help implement low-carbon strategies in the value chain, resulting in better competitive position and increased revenues. | Assistance for businesses in realizing recycling and reuse through technology improvement: water recycling, smart culturing, biogas generation, calcium fluoride sludge recycling, solar PV station, and fishery and electricity symbiosis. |